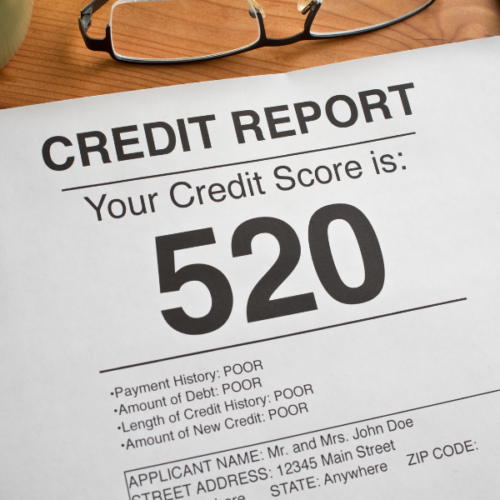

How Do I Fix My Credit Score?

Your credit score might be affected by inaccurate information

in your credit report.

These negative items can be removed in a short amount of time.

Sign up to get your FREE credit audit and see if there are any inaccurate items on your report that are affecting your score.

(This will not affect your credit score at all!)

5 Reasons You Should Repair Your Credit

1. Save Money On Insurance

If you have good credit, you can save money on your car insurance. Many insurance companies offer discounts to drivers who have a good credit score. This is because they believe that these drivers are less likely to file a claim.

2. Get A Lower Interest Rate

If you need to take out a loan, having good credit will help you get a lower interest rate. Lenders know that borrowers with good credit are less risky, so they offer them lower interest rates. This can save you a lot of money over the life of your loan.

3. Qualify For A Mortgage

If you want to buy a house, having good credit is essential. Lenders will look at your credit score when deciding whether to approve your mortgage application. A high credit score will help you get a lower interest rate on your mortgage, which will save you money in the long run.

4. Get Approved For A Credit Card

If you want to open a credit card account, having a good credit score is key. Many credit card companies only approve applicants who have a high credit score. This is because they believe that these borrowers are less likely to default on their payments.

5. Get A Better Job Offer

Employers sometimes look at an applicant’s credit score when deciding whether to offer them a job. A high credit score can show that an applicant is responsible and trustworthy. This may give you an edge over other candidates when applying for jobs. If you have bad credit, you may have trouble getting a job.

What Are The Benefits Of Hiring A Credit Repair Specialists To Fix Your Credit?

- Credit repair is the process of removing negative items from your credit report. When you have a good credit score, you can enjoy lower interest rates on loans and credit cards. You might also be able to get a car or home loan.

- Credit repair specialists can help you improve your credit score in a short amount of time. They know how to dispute inaccurate information on your credit report and they can help you build good credit habits.

When you have a good credit score, you can rest assured that you’ll be able to get a loan when you need it. A high credit score might also mean that you’ll qualify for a lower interest rate. This could save you thousands of dollars over the life of a loan